ny paid family leave tax deduction

Select the NYPFL code by typing NYPFL into the search box then click Save. Enter your gross wages for the pay period including estimated.

Ny Now Taking More From Your Paycheck For Paid Family Leave

I regularly work less than 20 hours per week but will not work 175 days in 52 consecutive weeks a year for this employer.

. Information on the option to opt-out of paid family leave and directions for completing this form can be found on page 2. Employers have the option to pay on behalf of their employees. Enter your gross wages for the pay period including estimated.

New Yorks Paid Family Leave provides employees with job-protected paid time off to. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. In the Configure Company area click Payroll then Deductions.

No pretax deductions allowed. Paid Family Leave may also be available in. This is 9675 more than the maximum weekly benefit for 2021.

1 Obtain Paid Family Leave coverage. Use the calculator below to view an estimate of your deduction. Use the calculator below to view an estimate of your deduction.

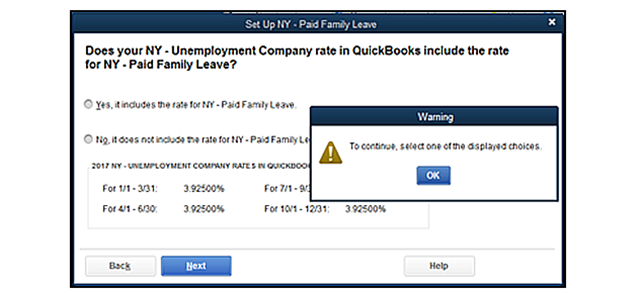

Set up New York Paid Family Leave Insurance. New York designed Paid Family Leave to be easy for employers to implement with three key tasks. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

In 2022 these deductions are capped at the annual maximum of 42371. In 2020 these deductions are capped at the annual maximum of 19672. 2 Collect employee contributions to pay for their coverage.

These contributions are separate and distinct from one another and may be funded by employees through payroll deductions. With a newly born adopted or fostered child care. Follow the steps below to set up a NY Paid Family Leave deduction.

Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. However premium for paid family leave is treated as the payment of a New York state tax. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

Employers may collect the cost of Paid Family Leave through payroll deductions. Form W-2 box 14 reporting. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Paid Family Leave may also be available for use in situations when an employee or their minor. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. Employers were permitted but not required to begin taking deductions from employee wages beginning on or after July 1 2017.

Employers paying self-funded benefits should report benefits paid to an employee as non-wage income on the employees W-2 form. The premium rate and the maximum employee contribution for coverage beginning January 1 2018 is set at 0126 of an employees weekly wage up to and not to exceed the statewide average weekly wage currently 130592. Use the calculator below to view an estimate of your deduction.

Private insurers must report. I would like to waive paid family leave coverage at this time because select one. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Paid Family Leave provides eligible employees job-protected paid time off to.

Intuit doesnt debit or pay paid family. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. For a family member with a serious health condition or assist loved ones when a family member is deployed abroad on active military service.

His employer should deduct 511 from his weekly paycheck since it is smaller than the SAWW which equals 511 per week or 26572 per year. In the Add Deduction window the required rate of 511 is automatically added. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

An employer is allowed but not required to collect contributions from its employees to offset the cost of providing disability and Paid Family Leave benefits. I understand that this. Paid family leave benefits are not treated as disability benefits for any tax purpose.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Employee-paid premiums should be deducted post-tax not pre-tax. Enter your gross pay for the pay period including estimated bonusescommissions.

Learn how to set up your payroll to track the paid family leave in New York. Withholding will automatically begin for eligible employees with checks dated January 1 2018. PFL premium payments cannot be deducted on a pretax basis from wages.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. The maximum weekly benefit for 2021 is 97161. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

They must be withheld from employees after-tax wages. Deduction and Waiver - DB and PFL. Paid Family Leave Benefits available to employees as of January 1 2018 may be financed by deductions from wages under a formula set by the New York State Superintendent of Finance on June 1 2017.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross wages each pay period. Click Add Deduction. Employers should report employee PFL contributions on Form W-2 using Box 14 State disability insurance taxes withheld Reporting of PFL benefits.

PFL-WAIVER 9-17 Page 1 of 2. Are the premiums paid under the Paid Family Leave program through employee payroll deduction considered. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period.

When an employee is on Paid Family Leave or vacation or any other paid leave he or she is not entitled to unemployment insurance benefits because he or she is still employed even if not required to perform work and because he or she is not available for work. If Douglas is eligible for PFL benefits in 2022 he will receive 670 per weekwhich is 67 of his own average wagesince that is less than 67 of the SAWW and proportionate to what he paid into the plan. An employees contribution is.

In 2021 these deductions are capped at the annual maximum of 38534. The weekly PFL benefit is capped at 67 of the New York State average weekly wage which is 97161. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. The state of New York has implemented a Paid Family Leave program funded by the collection of taxes from the employee. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

New York Paid Family Leave Resource Guide

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

Paid Family Medical Leave Update What Employers Need To Know In 2022 Reedgroup

Nys Paid Sick Leave Vs Nys Paid Family Leave

New York State Paid Family Leave Cornell University Division Of Human Resources

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

New Ny Paid Family Leave Tax To Be Deducted From Employee S Paychecks Starting July 1 2017 R Nyc

New York Paid Family Leave What You Need To Know For 2019

Get Ready For New York Paid Family Leave In 2021 Sequoia

Cost And Deductions Paid Family Leave

Cost And Deductions Paid Family Leave

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released