salt tax new york state

Can I sell my Home Processed goods to a local. The third set of draft regulations relate to apportionment and contain revisions to the apportionment.

State And Local Tax Salt Deduction Salt Deduction Taxedu

Click on the icon for your Adblocker in your browser.

. On July 1 2022 the New York State Department of Taxation and Finance issued the third set of final draft regulations relating to the corporation franchise tax reform that took effect for tax years beginning on or after January 1 2015. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. With 202 million residents it is the fourth most populous state in the United.

The election for the PTET is available for tax years beginning on or after January 1 2021. New York made up the next highest percentage of national SALT. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

Salt in the form of a natural crystalline mineral is known as rock salt or haliteSalt is present in vast quantities in seawaterThe open ocean has about 35 g 12 oz of solids per liter of sea water a salinity of 35. New York officially known as the State of New York is a state in the Northeastern United StatesIt is sometimes called New York State to distinguish it from its largest city New York CityWith a total area of 54556 square miles 141300 km 2 New York is the 27th largest US. New York allows New York City other selected cities school districts and certain transit districts to levy various wireless taxes in addition to county 911 fees.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The exact property tax levied depends on the county in Connecticut the property is located. While Silicon Alley metonymous for New Yorks broad-spectrum high technology.

The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe. Hasbro is paying The New York Times a licensing fee to release Wordle.

For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would reduce your liability. Salt is essential for life in general and. How to get rid of Biden in three easy steps.

NETR Online Salt Lake Salt Lake Public Records Search Salt Lake Records Salt Lake Property Tax Utah Property Search Utah Assessor. A new salt tax was introduced to the Republic of India via the Salt Cess 1953 which received the assent of the president on 26 December 1953 and was brought into force on 2 January 1954. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married.

New York With the highest average costs for minimum coverage car insurance and full coverage car insurance in the nation New York drivers typically pay significantly more for car insurance than. Connecticut is ranked 4th of the 50 states for property taxes as a percentage of median income. The Home Processor Registration Request can be submitted via email to.

Heres how to disable adblocking on our site. Diocletians official birthday was recorded at 22 December and his year of birth has been estimated at. For example the top rate kicks in at 1 million or more in California when the millionaires tax surcharge is included as well as in New Jersey New York and the District of Columbia.

Combined with the state sales tax the highest sales tax rate in New York is 8875 in the cities. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875There are a total of 640 local tax jurisdictions across the state collecting an average local tax of 4253. 2 Then again there is a still more wretched creature who bears the name of a laborer whose income may be fixed at thirty-five rupees per annum.

Finally Florida and Illinois have special state communications taxes with a local add-on that result in rates typically two times higher than the general sales tax rates. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

Who was in court. The federal tax reform law passed on Dec. HOWEVER the idea that each horror story resulting from Dobbs and these extreme state laws should be presumed false is an attempt to hide the consequences of their.

Scott is a New York attorney with extensive. A drop down menu will appear. Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon.

The Party Game a Wordle board game on October 1 for a suggested price of 1999. Diocletian was born in Dalmatia probably at or near the town of Salona modern Solin Croatia to which he retired later in lifeHis name at birth was Diocles in full Gaius Valerius Diocles possibly derived from Dioclea the name of both his mother and her supposed place of birth. Salt is a mineral composed primarily of sodium chloride NaCl a chemical compound belonging to the larger class of salts.

How do I submit the Home Processor Registration Request. One year and six months into his four-year term President Joe Biden could be finished in politics and in the White House if a jaw-dropping poll and a New York Times hit piece are. Here youll find the best how-to videos around from delicious easy-to-follow recipes to beauty and fashion tips.

Connecticuts median income is 85993 per year so the median yearly property tax paid by Connecticut residents amounts to approximately of their yearly income. California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions. Email protected or through the mail to the New York State Department of Agriculture and Markets Division of Food Safety and Inspection 10B Airline Drive Albany New York 12235.

11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for. New York City is a global hub of business and commerce as a center for banking and finance retailing world trade transportation tourism real estate new media traditional media advertising legal services accountancy insurance theater fashion and the arts in the United States. The New York Department of Taxation recently released long awaited guidance on the states SALT workaround otherwise known as the pass-through entity tax PTET.

In New York an additional top rate for income exceeding 25 million was enacted during the 2021 legislative session. Click here for a larger sales tax map or here for a sales tax table.

Nyc S High Income Tax Habit Empire Center For Public Policy

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

How Does The Deduction For State And Local Taxes Work Tax Policy Center

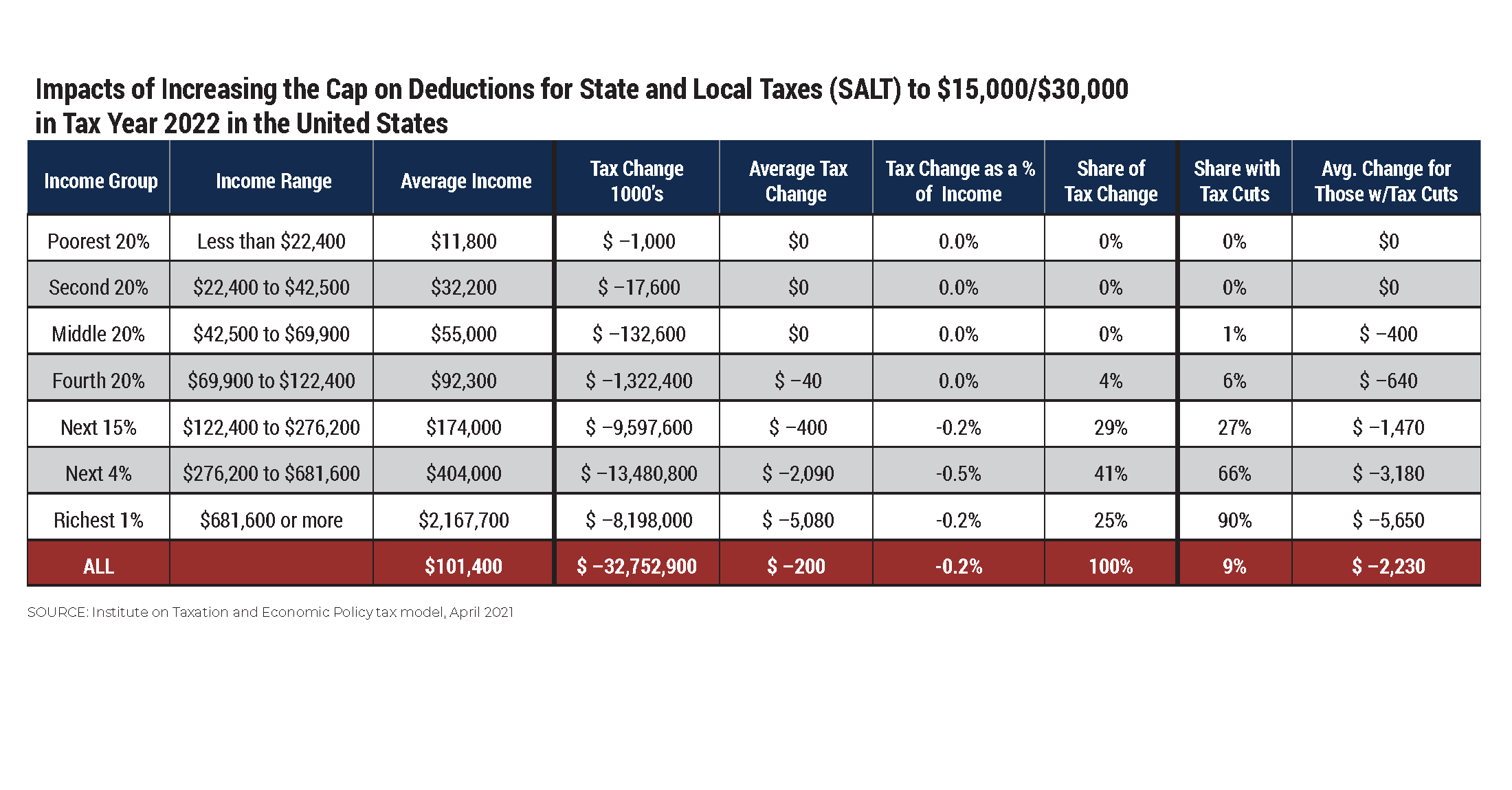

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Coping With The Salt Tax Deduction Cap

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Pass Through Entity Tax 101 Baker Tilly

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget